irs tax levy calculator

Ad Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season. To discharge the levy you usually have twenty-one days.

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

We have been helping individuals and small business.

. Helping You Avoid Confusion This Tax Season. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Of course an IRS levy doesnt happen overnight.

The IRS encourages everyone to use the Tax Withholding Estimator to perform a paycheck checkup. The IRS can issue a levy against only after these three requirements are met. The IRS uses a tax lien to secure that you pay off what you owe.

The consequences of a bank levy or wage garnishment can impact your credit score though. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. IRS imposes Failure to file and failure to pay penalty very commonly on taxpayers who did not file tax tax return within due date or did not pay tax on income shown on return or. Ad Have Unpaid Taxes.

Follow steps 1-4 to calculate disposable pay. 2 Deduct payroll taxes such as federal income tax Social Security tax Medicare tax and. Try Our Free Tax Refund Calculator Today.

A tax levy itself should not directly affect your credit score since IRS levies are not public record. The weekly exempt amount is now the total of 4150 as adjusted for inflation after 2018 multiplied by the number of the taxpayers dependents for the taxable year plus the. Open Connect Payroll Organization Calculation Tables.

Book A Consultation Today. See What Credits and Deductions Apply to You. 1 Calculate the employees gross pay for the pay period.

Pay Period Frequency select one Select from below. The bank will hold the funds for a maximum of twenty-one days and then they will release the funds to the IRS. Youll get notices of.

Ad Enter Your Tax Information. It is different from a lien while a lien makes a claim to your assets as. Enter dollar amounts without commas or.

Gross pay is income before deductions. Helping You Avoid Confusion This Tax Season. Married Filing Jointly 1.

Ad Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season. Tax changes as a result of the Tax Cuts and Jobs Act have altered the way. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

Once you have found the correct table find your payroll frequency in the first column and read across to the column for the number of allowances the employee claims on. Try Our Free Tax Refund Calculator Today. The IRS can levy or legally seize a taxpayers property to satisfy an outstanding back taxes.

A property tax levy is different from a tax lien as the lien is only a legal claim against your assets. The IRS assessed the tax and sent you a Notice and Demand for Payment. This will help you make sure you have the right amount of tax withheld.

By using this site you agree to the use of cookies. With a tax levy the IRS confiscates assets of yours such as the money in your savings account or a portion of your wages. Calculator OORAA Debt Relief is proud to be an expert in debt settlement with one of the most experienced teams in the industry.

The calculation table to calculate the IRS tax levy for the head of household is set up. The IRS can take as much as 70 of. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related.

We Offer A Free IRS Transcript Report Analysis 499 Value. An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages take money in your bank or other financial account seize and sell your.

Get Tax Relief That You Deserve With ECG Tax Pros.

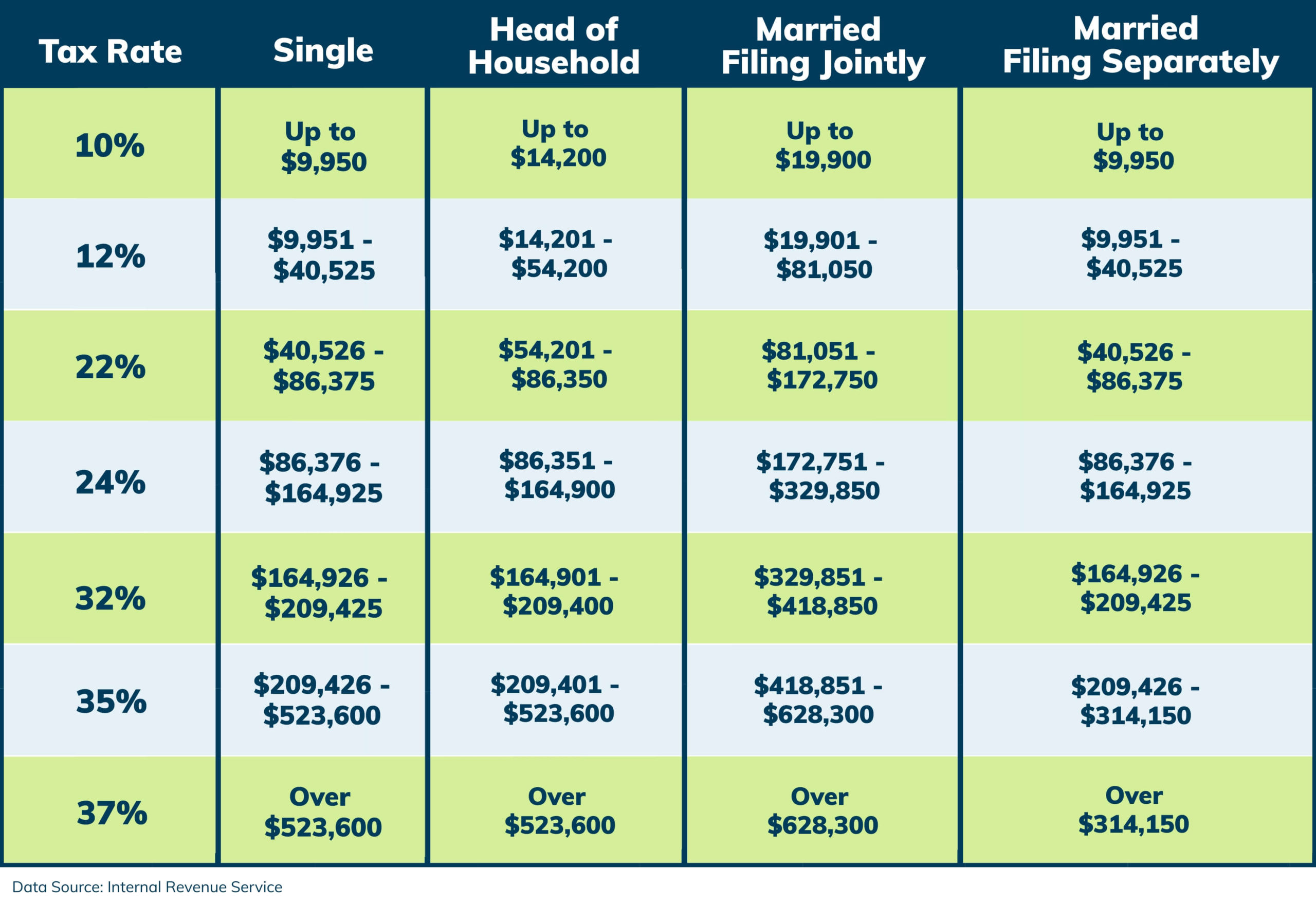

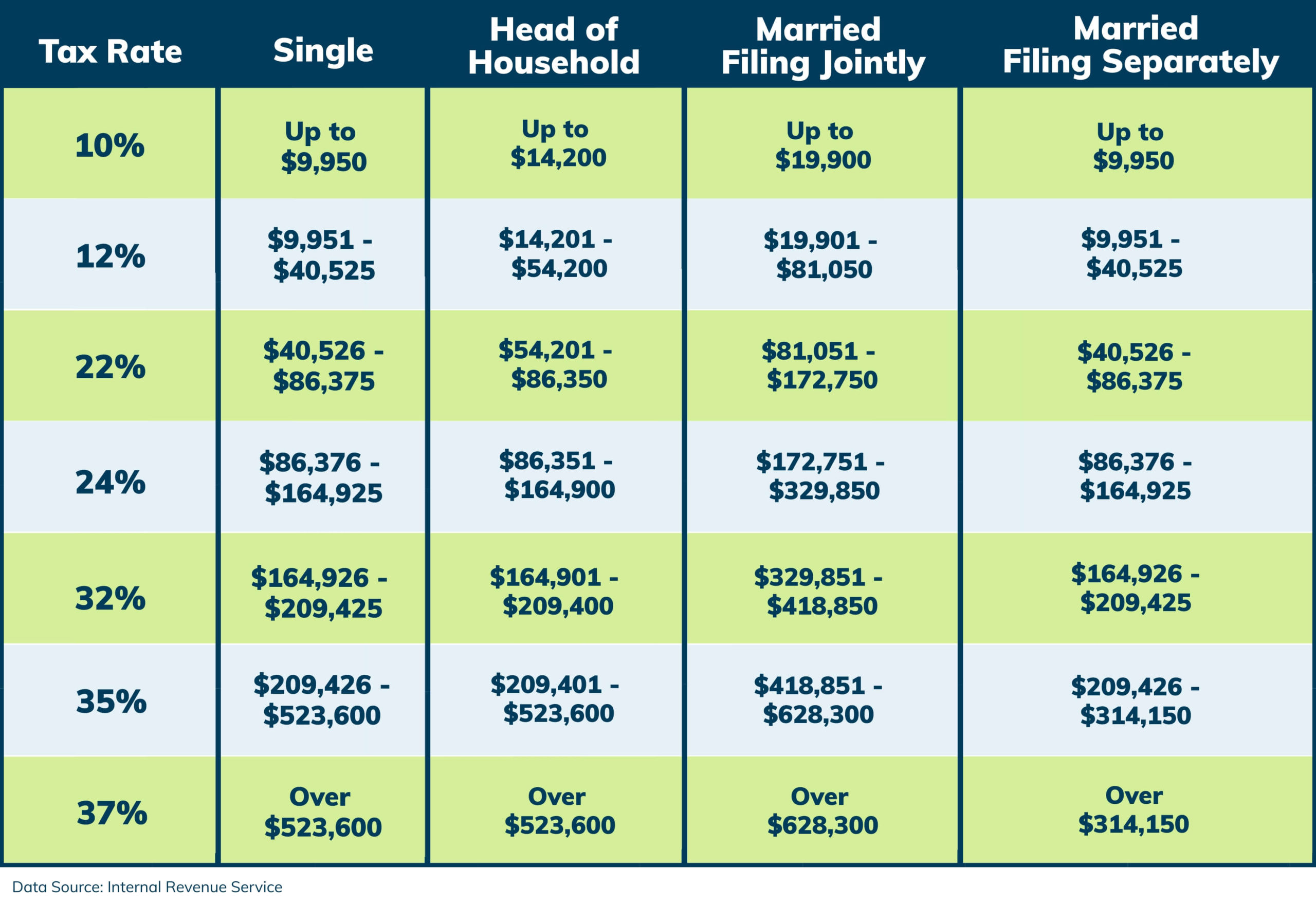

2021 Tax Brackets And Other Irs Tax Changes Tax Defense Network

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

Irs Tax Withholding Estimator Irs Com

What Is A Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien