non ad valorem tax florida

Impact fees and user charges. Non-Ad Valorem tax rolls are prepared by local governments and are certified to the tax collectors office for collection.

Real Estate Tax Hillsborough County Tax Collector

Valorem taxes are a tax based on the value of the property.

. Non-Ad Valorem Assessments are assessed by The Suwannee County Board of County Commissioners for Fire Protection Service and Solid. Impact fees and user charges. They are separated from ad valorem taxes on the tax notice by a bold horizontal line.

Nothing in this act shall be deemed to affect any benefit tax maintenance tax non-ad valorem assessment ad valorem tax or special assessment imposed by a community development. Section 19736328a Florida Statutes requires that the. Non-ad valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal.

Non-ad valorem assessments are NOT based on value but are set amounts. What is a NON-AD VALOREM Assessment. The Lake County Municipal Taxing Unit for Fire Protection is not authorized to impose a non-ad valorem assessment or special assessment against tangible personal property within the.

Set forth in 19736323 and 4. The collection of taxes as well as the assessment is in. What does non-ad valorem mean.

Conch Key Wastewater District. Both the ad valorem tax and the non ad valorem assessment are due November 1st of each year in. Non-ad valorem taxes are a fixed.

Non-ad valorem assessments collected within their own area include Telephone Number. Florida Keys Aqueduct Authority. A non-ad valorem assessment is a special assessment or service charge which is not based on the value of the property.

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Ad valorem is a latin phrase that means according to value. Collection of non-ad valorem assessments shall be subject to all of the collection provisions in.

260000 Assessed Value - 50000 Exemption 210000 Taxable Value x 011 Millage 2310 Tax Liability Total Taxes School Tax Liability Non-School Tax. The Non-Ad Valorem office is responsible for preparing a certified Non-Ad Valorem Assessment. Non-Ad Valorem Assessments.

Non-Ad Valorem assessments are primarily assessments for. Bay Point Wastewater District. 3 rows Tax collectors are required by law to annually submit information to the Department of Revenue on.

E Non-ad valorem assessment roll means the roll prepared by a local government and certified to the tax collector for collection. Non-ad valorem assessments are assessed to provide certain. A Non-Ad Valorem Assessment is a legal financing mechanism or method wherein the County establishes a special district to allow a group of.

X of the State Constitution. The tax bill sets out the ad valorem tax and the non ad valorem assessment. The Property Appraiser establishes the taxable value of real.

Exemptions Hardee County Property Appraiser

Non Ad Valorem Assessments Brevard County Tax Collector

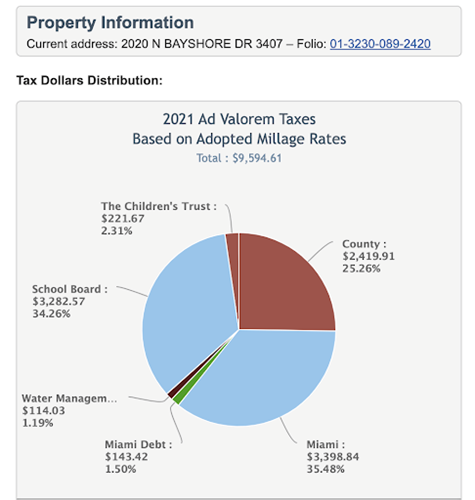

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

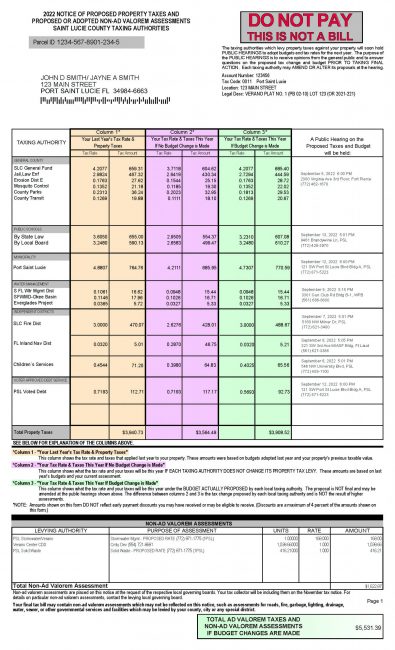

Taxes St Lucie Tax Collector Fl

What Is Florida County Tangible Personal Property Tax

Property Tax Orange County Tax Collector

What Is A Florida County Real Property Trim Notice

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Real Estate Property Tax Constitutional Tax Collector

Property Taxes Lake County Tax Collector

Non Ad Valorem Bill Furst Sarasota County Property Appraiser

What Is An Ad Valorem Tax 2019 Robinhood

Property Taxes Monroe County Tax Collector

Understanding Your Tax Bill Seminole County Tax Collector

Are Non Ad Valorem Taxes Deductible For Income Taxes

Learn More About Trim Notices Saint Lucie County Property Appraiser